Judicial Management in Singapore

When a company cannot pay its debts when it is due, they may opt for judicial management as a mechanism to enter a temporary moratorium against creditors claim.

The judicial manager may then make a decision to propose to achieve one or more of these purposes, such as:

(a) the existence of the company, or the whole or part of its undertaking as a going concern;

(b) the approval of a scheme of compromise or arrangement under section 210 of Companies Act; or

(c) the most advantageous realization of the company’s assets.

Such a moratorium would allow the company some time to make it more conducive for the company to achieve one of the three above purposes, rather than being cornered into liquidation (See application of creditors winding up the company to the court).

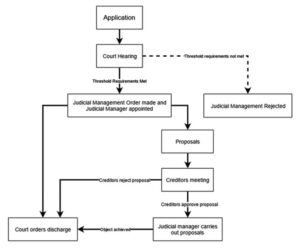

Application for judicial management

The application for a judicial management order results in the following restrictions:

(a) no creditor may enforce any security over the company’s assets (except with leave of court);

(b) if the company has goods on hire purchase, under a chattels leasing agreement or retention of title agreement, the goods may not be repossessed (except with leave of court);

(c) no legal proceedings may be commenced or continued against the company;

(d) no resolution may be passed or order made for the winding up of the company; and

(e) execution or a judgment already obtained may not be commenced or continued and distress may not be levied against the company’s property.

Which will be effective from the date of the application until the judicial management order is made or the application is dismissed.

Given the extensive restrictions imposed under section 227C of the Companies Act, it can be seen that such an application may be abused to prevent creditors from legitimately enforcing their rights.

To control any abuse, the court is empowered to dismiss the application; and if it thinks that the application was presented frivolously or vexatiously, it may make such orders as it thinks just and equitable to redress any injustice that may have been caused.

How to apply for judicial management

Under the Companies Act, the following persons may apply to the court for a judicial management order:

(a) the company, through a resolution of its members or its board of directors; or

(b) one or more creditors, including any contingent or prospective creditor.

Appointing the judicial manager

The person making the application for judicial management will nominate the judicial manager in the process.

The nominee judicial manager should be a public accountant who is not the auditor of the company.

The court, in considering the application, may reject the nomination and appoint another person instead, or the Minister may himself nominate a person to act as a judicial manager if he considers it in the public interest to do so.

A judicial manager appointed by the court or nominated by the Minister does not need to be a public accountant.

The majority in number and value of the creditors (including contingent or prospective creditors) of a company may oppose the nomination of a person proposed as judicial manager by the applicant. If the court is satisfied with the grounds of opposition, it may invite the creditors to nominate another person instead, and if it sees fit, adopt their nomination.

Hearing of the application

The applicant for a judicial management order must establish the following before the court may decide on whether to make a judicial management order:

(1) on a balance of probabilities, the company is or will be unable to pay its debts; and

(2) there is a real possibility that the making of the order would be likely to achieve one or more of these purposes:

(a) the existence of the company, or the whole or part of its undertaking as a going concern; or

(b) the approval of a scheme of compromise or arrangement under section 210 of the Companies Act; or

(c) a more advantageous realisation of the company’s assets than would be affected on a winding up.

Exceptions/limits to the court’s jurisdiction to grant judicial management order

Judicial management is only applicable to companies that are incorporated in Singapore.

Under the Companies Act, the following companies are excluded from being able to be placed under judicial management:

(a) where the company has already gone into liquidation;

(b) where the company is a bank licensed under the Banking Act (Cap 19) or is a finance company licensed under the Finance Companies Act (Cap 108); or

(c) where the company is an insurance company licensed under the Insurance Act (Cap 142).

A qualifying floating charge holder may also veto an application for judicial management, as it would be a person who “is entitled to appoint a receiver and manager” under section 227B(5)(b) of the Companies Act.

The court will also consider whether it is in the “public interest” to make a judicial management order, even if the debenture holder opposes the application or if it has appointed a receiver and

manager or intends to do so.

Re Cosmotron Electronics (Singapore) Pte Ltd

The court on the above case has jurisdiction to make an order on the grounds of public interest, even when the applicant is not able to establish that the company is insolvent (or is likely to become insolvent) or that the making of an order will achieve one or more of the purposes set out under section 227B(1)(b) of the Companies Act.

Re Bintan Lagoon

The court held that it would consider the “serious economic or social impact” in the collapse of the company seeking to be placed in judicial management, hence the court will only exercise its power to make an order on the grounds of public interest under exceptional circumstances.

Effect of a judicial management order

When a judicial management order is made, the functions and powers of the board of directors are transferred to the judicial manager, except that the judicial manager will not have to call any meeting of the company that are required under the Companies Act, apart from any meetings that are necessary for her to fulfil her duties as a judicial manager.

Discharge of the judicial manager

A judicial management order is discharged after a period of 180 days unless extended by the court.

Accordingly, the judicial manager is discharged after the same period.

The judicial management order may also be discharged before 180 days in the following cases:

(a) where the creditors decline to approve the judicial manager’s proposals;

(b) where the court orders by reason of the judicial manager acting in a manner unfairly prejudicial to the creditors or members; or

(c) where, on the application of the judicial manager, it appears that the purposes of the judicial management order cannot be achieved.

The judicial manager may also resign with leave of court as stipulated by the Companies Act.

In any case, a judicial manager must vacate her office if the judicial management order is discharged, or the judicial manager ceases to be a public accountant if she was a public accountant at the time of her appointment.