Tianlong Audit Methodology

The Ultimate Guide to Auditing

You are here: Tianlong Audit Methodology / Initial Planning / Establish The Team Roles & Responsibilities

Chapter 1: Initial Planning

Establish The Team Roles & Responsibilities

Responsibilities of the partner in charge of the audit

The partner in charge of the audit has overall responsibility for:

- The audit and its performance

- The auditor’s report that is issued on behalf of Tianlong Services

The overall quality of the audit.

In fulfilling these responsibilities, the partner in charge of the audit may rely on Tianlong Services’ system of quality control.

The partner in charge of the audit may rely on Tianlong Services’ system of quality control for:

- Developing the knowledge and experience of audit team members through recruitment, learning, and performance and development processes

- Monitoring adherence to policies and procedures through audit quality review (AQR) processes

- Monitoring the independence of audit team members

- Client and engagement acceptance and continuance

Although the partner in charge of the audit has primary responsibility for the overall quality of the audit, members of the audit team share this responsibility and assist the partner in charge in fulfilling the responsibilities described above.

The signature of the partner in charge of the audit on the Review and approval summary (RAS), together with other evidence of involvement in the planning and execution of the audit, acknowledges the conclusions of the partner in charge regarding the overall performance and quality control of the audit as a basis for issuing the auditor’s report.

Establish our team

We determine the nature, timing and extent of resources required to perform the audit.

We make a preliminary assessment of additional expertise that is needed beyond that possessed by the audit team’s current members and develop a plan to obtain the resources.

We determine whether to use the expertise of a Tianlong internal specialist or an auditor’s external specialist.

We re-evaluate the nature, timing and extent of supervision and review required to perform the audit when circumstances change significantly during the course of the audit.

We determine whether any other firms participate in the audit and evaluate whether they meet the criteria to be a substantial-role. When the firm meets the criteria, we communicate this determination to them.

We expect the audit team, as a whole, to have:

- An understanding of, and practical experience with, audits of a similar nature and complexity through appropriate training and direct participation in such audits

- An understanding of relevant professional standards and regulatory requirements, including Independence and other relevant ethical requirements

- Appropriate technical knowledge, including knowledge of IT relevant to the audit

- Knowledge of industry sectors in which the entity operates

- The ability to apply professional judgment

- An understanding of the Tianlong’s quality control policies and procedures, including Independence

To establish the team, we:

- Identify the staffing requirements on a timely basis.

- Prepare time budgets to determine the resource requirements and to schedule the work.

- Achieve an appropriate balance of skills, experience and competence within the team, by considering:

- Audit size and complexity

- Personnel availability

- Specialized knowledge required

- Timing of the work to be performed

- Continuity and periodic rotation of team members

- Opportunities for on-the-job training

- Situations when possible independence issues and conflicts of interest may exist (e.g., considering if team members have certain relatives employed by the entity).

- Consider the experience and training of the team members in relation to the complexity or other requirements of the audit.

- Determine the management, supervision and direction of the audit team required. Identify those team members with responsibility for these activities.

Our establishment of the team and our supervision and review of team members is an iterative process. We make adjustments to our supervision and review during the planning phase of the audit, during our PIE, and whenever circumstances change significantly during the course of the audit. Such changing circumstances on the audit may include one or more of the following:

- Significant turnover of key audit team members (primarily at the senior, manager and/or senior manager level)

- Significant events pertaining to the entity or the audit causes unexpected workload changes of audit team members (e.g., significant acquisition, divestiture or unusual event by the entity)

- Significant change in the experience of audit team members (e.g., industry or tenure with the firm)

The partner in charge of the audit determines that the competence and capabilities of the audit team and any specialists necessary for the execution of the audit are appropriate to:

- Perform the audit in accordance with TAM and with relevant legal and regulatory requirements

- Enable an appropriate auditor’s report to be issued

Tianlong professionals who have specialized knowledge

An audit team comprises Tianlong professionals with accounting and auditing expertise. In some cases, to address the specific needs of the audit, such as a more complex tax environment or need for specialized industry knowledge, the team also involves professionals who not only have accounting and auditing expertise, but also specialized knowledge of IT, tax or an in-depth knowledge of a particular industry sector. These audit team members are not specialists.

In particular, we include Tianlong professionals with relevant specialized knowledge on the team when the entity:

- Has a complex IT environment

- Has a complex tax environment

- Operates in a specialized industry sector

Although the team may have a good understanding of the industry sector in which the entity operates, a deeper knowledge may be required for some aspects of the audit.

Even though the team has IT knowledge, an IT professional is included on the team to assist with the IT elements of the audit when the IT environment is complex.

Although the team has knowledge about tax matters, a tax professional is included in the team to assist when the entity’s tax environment or calculations are complex (e.g., the income tax provision, or the entity’s goods and services tax (GST) or customs duties).

In the audit of a life insurance entity, although the team and the partner in charge of the audit have a good understanding of the life insurance industry, the team may also include professionals who have the specialized knowledge to audit the actuarial valuations.

When we include Tianlong professionals on the team with specialized knowledge of IT, tax or the industry sector in which the entity operates, the Tianlong professionals’ work is directed, supervised and reviewed.

Tianlong professionals with specialized knowledge are encouraged to attend the team events, and they participate directly in the performance of audit procedures.

In determining whether specialized knowledge is needed in relation to the entity’s accounting estimates, we consider:

- The nature of the underlying asset, liability or component of equity in a particular business or industry

- Whether there is a high degree of estimation uncertainty

- Whether complex calculations or specialized models are involved, for example, when estimating fair values when there is no observable market

- The complexity of the requirements of the applicable financial reporting framework to accounting estimates, including whether there are areas known to be subject to differing interpretation or inconsistent or developing practices

The procedures we intend to undertake in responding to the risk of material misstatement

Involving IT professionals

We include Tianlong professionals with specialized knowledge of auditing IT, if necessary, based on our understanding of the extent to which the entity uses IT and the complexity of the entity’s IT environment.

To determine the extent of IT professional involvement, we determine:

- The overall IT complexity. In more complex IT environments, Tianlong professionals with specialized knowledge of auditing IT develop an understanding of the IT environment and assist in obtaining an initial understanding of IT-related risks of material misstatement.

- How IT affects our audit strategy. As an entity’s operations and IT environment become more complex and sophisticated, it becomes more dependent on IT. It is therefore important that we use our understanding of IT when determining our audit strategy.

- The IT knowledge of those individuals already assigned to the audit team.

Involving tax professionals

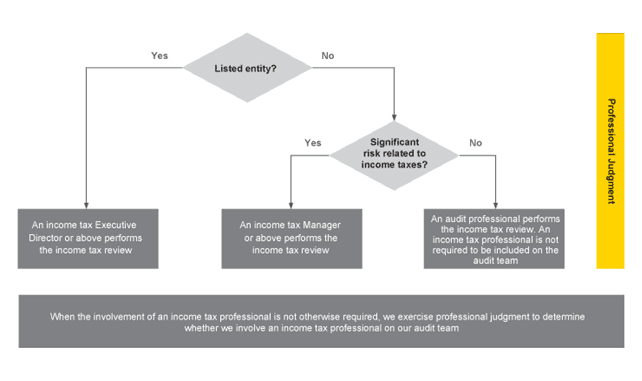

For listed entities and other PIEs, an income tax executive director, principal or partner performs a tax review of income tax amounts and disclosures in the financial statements.

For entities with significant risks related to income taxes, an income tax manager or above performs a tax review of the financial statements and disclosures related to income taxes.

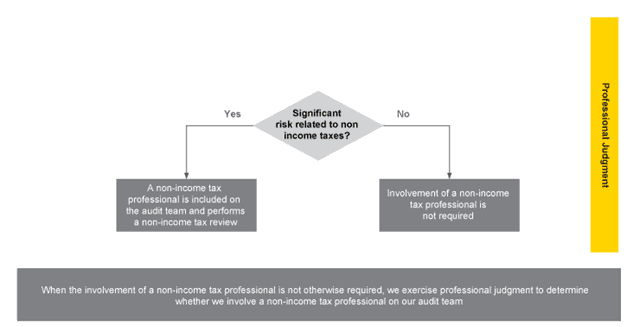

We include a non-income tax professional on the audit team when we identify significant risks related to non-income taxes.

When the involvement of a tax professional is not otherwise required, we exercise professional judgment to determine whether we include an income tax or a non-income tax professional on the audit team.

When we have not identified significant risks related to income or non-income taxes, we determine whether to include a tax professional on the team by considering:

- The significance of the non-income tax accounts and related disclosures

- The complexity of the technical accounting and non-income tax issues

- The entity’s industry

- The complexity of the entity and its environment

- The competence and capabilities of the audit team

If the non-income tax is a simple percentage of sales, with few exemptions, audit professionals on the audit team may be able to test the non-income tax collected and remitted. If the non-income tax is more complex, with many exemptions or different applicable rates, a non-income tax professional may be required to assist in determining whether the entity has accurately recorded its non-income taxes.

We consider whether the entity has sufficient and appropriate resources to manage the non-income tax accounts. It is important to determine whether management and staff understand, take responsibility for and can administer, the relevant non-income taxes.

When exercising our professional judgment with regard to the composition of the team.

We also consider obtaining the assistance of a non-income tax professional to help determine the complexity and risk associated with the non-income tax accounts, to conclude whether a non-income tax professional (income tax or non-income tax) is included on the audit team.

With regard to non-income taxes, it is important to be aware that:

- The number and monetary amount of transactions recorded in the account during the period may be significant, even if the period end balance is not material

- For some non-income taxes, the non-income tax is recorded in the same account as the originating transaction (i.e., customs duties may be added to the cost of goods or services)

- Some exemptions available for certain types of non-income tax are only valid if annual or periodic compliance obligations are completed

Therefore, non-income taxes may be significant even if there is only an immaterial, or no, balance in the financial statements at the end of the period.

We include Tianlong professionals with specialized industry knowledge on the audit team, if necessary, based on our understanding of the industry in which the entity operates.

Involving professionals with specialized industry knowledge

We expect the audit team’s understanding of the industry to be sufficient to evaluate whether the audit evidence obtained is sufficient and appropriate to support our audit opinion. However, if a deeper and more specialized knowledge is required in the team, one or more professionals with specialized industry knowledge may be included on the team to assist in performing and concluding on the audit procedures.

When determining whether specialized industry knowledge is required, we consider whether:

- The industry has specialized business practices

- The entity’s financial statements contain significant accounts or accounting policies that are unique to the industry

- The valuations of assets or liabilities use industry-specific methodologies, models or assumptions

When we audit:

- A real estate management entity, we may include real estate valuation professionals on the audit team to audit the real estate portfolio

A pension plan, we may include professionals with specialized knowledge of pensions legislation on the audit team

Determine the need to involve a specialist

We are not expected to have the expertise of a person qualified to engage in the practice of another profession or occupation (e.g., an actuary, geologist or engineer). When such expertise is required in order to obtain sufficient appropriate audit evidence, we consider whether to use the work of an appropriate specialist.

In determining the need for a specialist, we assess:

- The audit team’s knowledge and previous experience of the matter being considered

- The experience of the audit team members who will be performing the audit procedures

- The quantity and quality of alternative sources of audit evidence available

- The significance of the financial statement assertion, account or disclosure in relation to the financial statements as a whole

- The nature, timing and extent of our other procedures related to the accounts affected

We may use the work of a specialist to:

- Value land and buildings, plant and machinery, jewelry, works of art, intangible assets, complex financial instruments, assets and liabilities in business combinations, and impairments

- Understand technical aspects of the entity’s business (e.g., engineers for oil and gas reserves)

- Calculate the liabilities from insurance contracts or pensions

- Value environmental liabilities and clean-up costs

- Analyze complex or unusual tax issues

- Measure work-in-progress

- Interpret technical requirements, statutes, regulations or agreements (e.g., contracts, legal documents or legal title to property)

- Review the work of another specialist (e.g., to corroborate the findings of a management’s expert)

Determine the physical characteristics relating to quantity on hand or condition (e.g., quantity or condition of minerals, or materials stored in stockpiles).

Team roles and responsibilities

When performing and reviewing audit documentation, the team members identified below carry out the following tasks.

Experienced staff below manager (e.g., seniors) |

|

Audit executives other than the partner in charge of the audit (e.g., managers through partners) |

|

Audit partners, including the partner in charge of the audit |

|

Engagement quality reviewer and other quality reviewers

When an engagement quality review, IFRS pre-issuance technical review or cross-border capital markets review is required by Tianlong policies, the partner in charge of the audit:

- Determines that the relevant quality reviewers have been appointed

- Remains alert for changes in circumstances that would require one or more such review

- Discusses significant accounting and auditing issues arising during the audit with the quality reviewers, including those identified by the quality reviewers

- Does not issue the auditor’s report until such quality control reviews are complete and related matters are resolved to the satisfaction of the corresponding reviewer

When an Area or Region requires other pre-issuance reviews, the partner in charge of the audit does not issue the auditor’s report prior to compliance with relevant Area or Region approval processes.

Professional Practice

Those Professional Practice professionals providing such consultations, receiving such notifications or granting advance approvals under our policies are not considered part of the audit team and their work is not managed, directed or supervised by the audit team.

Budgets

Appropriate budgeting and timely recording of time spent on a particular audit is an essential part of directing and managing the timely completion of the audit.

The partner in charge of the audit approves the budget; audit team members monitor and revise it as changes occur during the audit.

Budgets are used to:

- Facilitate the scheduling of staff on the audit

- Assist in allocating the correct levels of staff to each audit so that their skills are matched to the audit work involved

- Schedule work so that the audit executives can provide timely, direct participation in the audit process

- Appropriately allocate time to the audit work

- Identify the roles and responsibilities of the audit team members, including responsibilities for reviewing the work performed and for directing and supervising the team

- Estimate the cost of the audit before the work commences

- Substantiate the cost of our professional services and, in particular, any increase in our fees

- Enable preparation of future budgets, having regard to previous actual experience

We allocate time and resources to audit areas commensurate with the combined risk assessment (i.e., we allocate more time or resource or both to audit areas with more risk or complexity). The development of appropriate budgets and the monitoring of actual time spent compared with the budget helps audit executives to direct appropriate audit effort to high risk or other sensitive audit areas, as well as in bringing issues to management and keeping track of extra time spent for billing purposes. As necessary, we adjust the budget to take account of changes in our audit strategy.

Evaluate compliance with ethical requirements, including independence

We perform procedures to determine compliance with ethical requirements, including independence, prior to performing other significant activities for the current audit period.

Differences of professional opinion

As necessary, the partner in charge of the audit reminds members of the audit team that they may bring matters involving differences of professional opinion to his or her attention or to the attention of others within Tianlong as appropriate without fear of reprisals.

Documentation

Work prepared by Tianlong professionals with specialized knowledge who become part of the audit team is documented in accordance with the documentation requirements of TAM and is part of our audit documentation.

Topics under chapter 1: Initial Planning

No Obligation

Request a free trial

You will get a month’s worth of bookkeeping. Whether or not you continue with us, your reports for the month are yours to keep.