Tianlong Audit Methodology

The Ultimate Guide to Auditing

You are here: Tianlong Audit Methodology

Introduction

Using Tianlong Audit Methodology (TAM)

This Audit Methodology (we name it Tianlong Audit Methodology (TAM)) provides a framework for applying a consistent thought process to all audits. You can apply this TAM to your audits but is customized to address the characteristics of the type of entity under audit and the auditing standards applicable to the audit.

Overview of TAM

The Tianlong Audit Methodology (TAM) provides a framework for the application of a consistent thought process to all audits. TAM is based on International Standards on Auditing (ISAs) and is supplemented with local content developed by us to comply with local auditing standards (Singapore Standards of Auditing (SSAs)) and regulatory or statutory requirements in Singapore.

TAM contemplates timely executive involvement in the audit and allows the use of alternative strategies based on professional judgment and audit team input. Do remember that this guide is a means to an end and not a set of rigid instructions to be followed without the use of professional judgment.

Read our blog post on audit principles here.

TAM structure

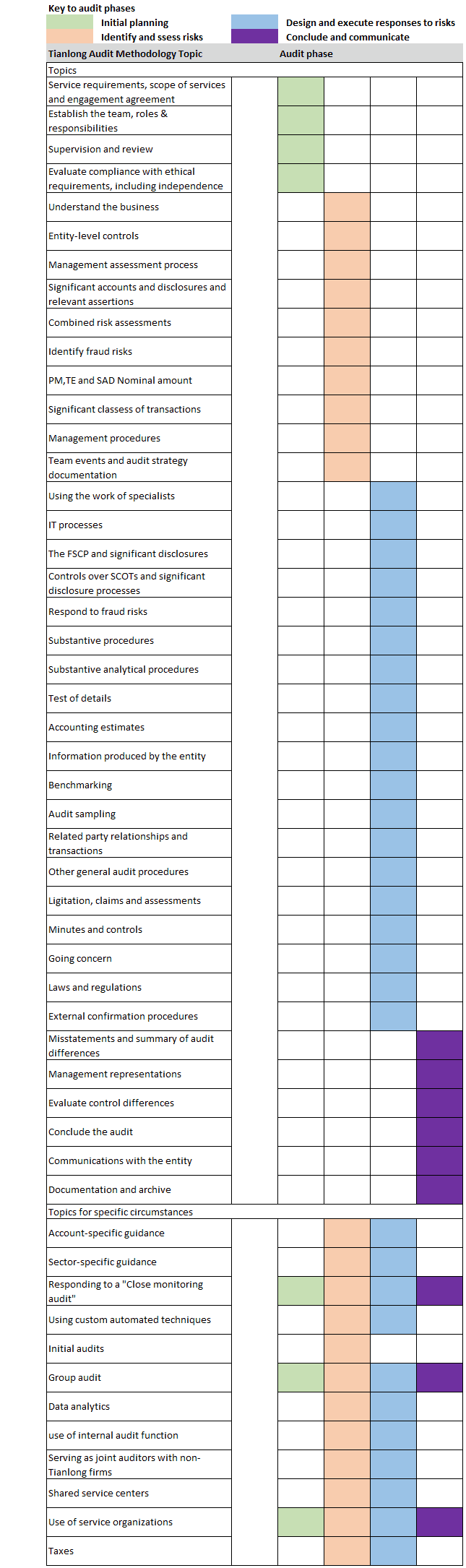

TAM is arranged into audit topics. Each topic contains the requirements and guidance for the activities you can perform as you move through the phases of your audit:

- Initial planning

- Identify and assess risks

- Design and execute responses to risks

- Conclude and communicate.

To complete your initial planning, you can first determine the scope of your services and meet with those charged with governance and/or management to determine their expectations and service requirements. In addition, you will establish your team, including, as appropriate, professionals with specialized knowledge, such as tax or IT, and specialists, such as valuations specialists.

Topics included in this chapter:

- Service requirements, scope of services and engagement agreement

- Establish the team, roles & responsibilities

- Supervision and review

- Evaluate compliance with ethical requirements, including independence

As you identify and assess the risks of material misstatement, you will obtain a broad understanding of the entity, including the nature of the business and its environment and the risks that the entity faces. You can then determine the materiality and what accounts and disclosures are significant.

You can also identify the risks of material misstatement due to fraud or error, and relate these risks to the financial statements as a whole and to relevant assertions for significant accounts and disclosures. From your understanding of the significant classes of transactions (SCOTs), significant disclosure processes, the financial statement close process (FSCP) and how IT affects the financial statements, we make our preliminary combined risk assessments (CRAs).

Topics included in this chapter:

- Understand the business (UTB)

- Entity-level controls (ELC)

- Management assessment process

- Significant accounts and disclosures and relevant assertions

- Combined risk assessments (CRA)

- Identify fraud risks

- PM,TE and SAD Nominal amount

- Significant classess of transactions (SCOTs)

- Management procedures

- Team events and audit strategy documentation

You determine your audit strategy and develop an audit plan, by designing a response to the risks of material misstatement that you have identified. You then determine the nature, timing and extent of your tests of controls and the substantive procedures that you plan to perform to respond to the assessed risks. In addition, you perform specific audit procedures in areas such as related party transactions, laws and regulations affecting the entity, the use of the going concern basis of accounting by the entity and any litigation involving the entity.

You execute your audit as per your understanding of SCOTs, significant disclosure processes and controls, and perform the planned tests of controls, substantive procedures and other specific procedures. You then evaluate your results, and reassess the combined risk throughout the audit to determine whether changes are necessary to your audit strategy in response to a change in your CRAs.

Topics included in this chapter:

- Using the work of specialists

- IT processes

- The FSCP and significant disclosures

- Controls over SCOTs and significant disclosure processes

- Respond to fraud risks

- Substantive procedures

- Substantive analytical procedures

- Test of details

- Accounting estimates

- Information produced by the entity

- Benchmarking

- Audit sampling

- Related party relationships and transactions

- Other general audit procedures

- Ligitation, claims and assessments

- Minutes and controls

- Going concern

- Laws and regulations

- External confirmation procedures

You can now complete your audit and communicate your significant findings and issues with those charged with governance and/or management. You assess whether your team have obtained sufficient appropriate audit evidence to provide you with reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error.

Throughout the audit, when you obtain new or updated information, you revisit and revise your procedures.

Topics included in this chapter:

- Misstatements and summary of audit differences

- Management representations

- Evaluate control differences

- Conclude the audit

- Communications with the entity

- Documentation and archive

The following chart lists all of our TAM topics and where in the audit the topic is relevant. You can use it for your audit engagements.

Structure of each topic

Each topic follows a similar structure, as follows:

- Purpose – provides an explanation of the topic contents and why it is important.

- Requirements – requirements that you can follow on every audit, if applicable in the circumstances of the audit, either because you are required to do so by professional standards or because you have deemed it necessary for your risk management.

- Explanatory guidance – TAM contains guidance in the form of application and other explanatory material which provides context relevant to a proper understanding of the requirements. You can have an understanding of the entire text of TAM in order to understand the objectives of the requirements and how to apply them properly.

- Documentation requirements – explain how to document your procedures, findings, results and conclusions. The documentation requirements are enabled by a suite of Forms. Use of these forms will result in achieving the requirements of your audit.

- Forms – provides links to the form pages relevant to the TAM topic. The topic pages list relevant content, such as forms and external standards.

- Appendices – provide further guidance and examples and/or describe detailed procedures that are applied when the circumstances in the appendix exist.

Forms

The Forms provide the documentation necessary for your audit. Forms that are designated as “Required” are required to be completed on every audit when the circumstances apply. Required forms are mainly because of professional requirements and as required by the relevant auditing standards set forth by the country’s authority. Optional forms may be used at the discretion of the audit team.

No Obligation

Request a free trial

You will get a month’s worth of bookkeeping. Whether or not you continue with us, your reports for the month are yours to keep.