I will not go through the definition of corporate governance in this article. You can find it on Google easily. Instead, I will be talking about how to implement corporate governance to pick stocks. First of all, it is important to know certain terms before moving on.

Required knowledge

- Conflict of interest

- Unqualified opinion

- Approaches to corporate governance

This portion is to give you a crash course in a small portion of corporate governance. It is only required to understand this article and begin applying corporate governance to pick stocks. If you want to find out more about corporate governance alone, this article is not for you. Let’s dive in.

Conflict of interest means that each of the stakeholders has different interest and claims on a company. For example, between a shareholder and employee. The employee would like to get paid higher, but it is a cost to the shareholder, who would also want higher returns.

Unqualified opinion means that the audit on the financial statements presents a true and fair view, and that the users can rely on the financial statements.

Approaches to corporate governance

There are three approaches to corporate governance. The shareholder approach, the stakeholder approach and the enlightened shareholder approach.

First, the shareholder approach means that the company existence is to serve the shareholder. Maximizing shareholder’s returns may be the business’ main objective. Normally if there is a dominant or majority group of shareholders, the company’s approach is the shareholder approach.

Next, the stakeholder approach. As you can imply from above, the company exists is to serve the stakeholder. Stakeholder here depends on the company’s profile. For example, schools and universities exists to create value for students, and not to maximize value for the unitholders or the school donors.

Lastly, the enlightened shareholder approach. This is somewhere in between both approaches above. An example would be a large corporation whose operations affect the environment. For example, it could be Shell International or ExxonMobil.

Let’s begin our analysis. We will be analysing Singtel in this article. You can download Singtel’s annual report 2017 first before continuing.

Conflict of interests

Remember, corporate governance is about ensuring that the decisions made would benefit the shareholders and/or stakeholders in the long-term. To begin, we have to answer the following questions.

- Is the company made up of many individual shareholders or a few majority shareholders?

- What are the audit fees?

- What is the remuneration of key management personnel?

Is the company made up of many individual shareholders or a few majority shareholders?

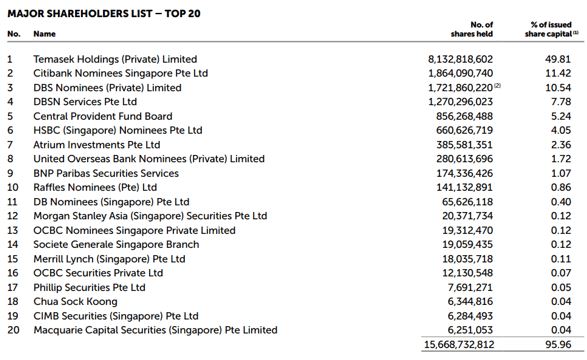

The first question addresses the risk of a dominant individual or group of individuals makes decisions in their self-interests. To find out, look at the annual report of the company that you are researching. There will most likely be a section on the information of shareholders. Below is an example of Singtel’s annual report 2017.

From the picture above, we can see that Temasek Holdings is the majority shareholder. The top five shareholders alone own a massive 84.79% of the company. We can deduce two things from this information.

First, the Board of Directors has no power over the shareholders. They cannot act in their own self-interest. However, all they need to do is to satisfy a few shareholders to get re-elected, which may be in their self-interest.

Second, if you own shares in Singtel as an individual, most likely you are not going to make an impact in the decision making in Singtel’s policy.

In general, in a company that has a dominant shareholder, she may make decisions in her self-interest over the minority shareholders. She may also be in the Board of Director and be in the management team herself.

This information alone is not enough to make an investment decision. Let’s answer the second question.

What are the audit fees?

Next, we look at the audit fees. Research on the audit fees of similar industry and size. Research on the audit firm as well if necessary to find out if the fee is a large portion of the audit firm’s revenue. If the amount is huge, there may be a conflict of interest issue because it is in the auditors’ interest to keep this high paying client.

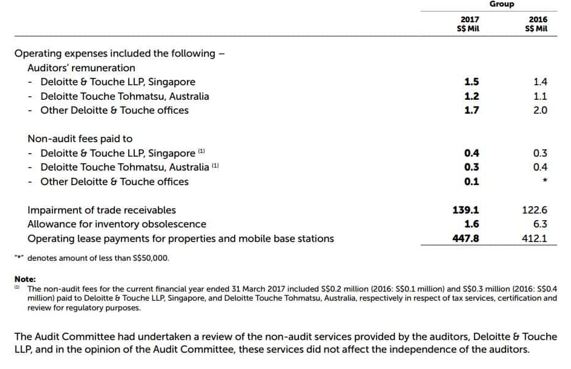

Again, below is an excerpt of Singtel’s annual report on auditors’ remuneration.

I do not know the industry average audit fees and not going to research for the purpose of this article. The point to look here is the statement below. It states that in the Audit Committee’s (AC) opinion, the non-audit services did not affect the independence of the auditors.

To make a judgment if this is reliable, look at the AC’s profile. If the profile consists of different age group of people, ethnicity, and background, perhaps it is safe to conclude that they are independent of each other. Also, the members should not have an interest in the audit firm, which is Deloitte.

In general, if it is audited by a Big Four accounting firm, it is relatively easy to find out the revenue of each of the firm. In this case, let’s Google Deloitte’s revenue for 2017. We can see that Deloitte made $38.8 billion in 2017 globally.

Singtel’s fees turn out to be less than 0.1% of the total firm’s revenue. We conclude that the audit fees do not cause an independence or conflict of interest issue between Singtel and Deloitte.

From this conclusion, we now know that Deloitte doesn’t have any interest to issue an unqualified opinion. It is issued on the basis of professional judgment and not through any interest. We can, therefore, rely on the independent auditor’s report on Singtel’s annual report.

After having known this information, we need to look further into the remuneration of management and determine if they are reasonable. Let’s dive in by asking ourselves the third question.

What is the remuneration of key management personnel?

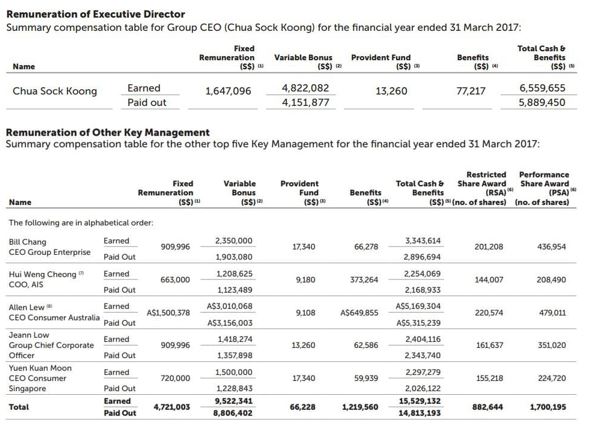

You can find the remuneration of key management personnel usually in the corporate governance section of the annual report. Below is an extract of Singtel’s annual report 2017. It shows the remuneration of the executive director and other key management.

After we have all this information, we need to make a judgment if the fees are too high. To do this, let’s take a look at the profit the company generates.

In the Income Statement section of the annual report, the company made 3.8 billion dollars in 2017. The total remuneration of Executive Director and other key management turns out to be about 20 million, which is less than 1% of the profit. It turns out to be fairly reasonable in my opinion.

Remember that we analyzed the shareholders’ information above? We see that only 5 shareholders own more than 80% of the company shares, or 7 shareholders own more than 90% of the company. This is consistent with the data we see from the remuneration of management. If there are a dominant or group of majority shareholders, they would want to achieve as much return as possible from the company, and not be paid to management.

While only 7 shareholders own more than 90% of the company, and you are not likely to make an impact in Singtel’s policy, the returns are attractive as an investment. Why are the returns attractive? Because from our discussion above, we noted that there are dominant shareholders in Singtel. They want the highest return possible.

The company’s view of corporate governance

We cannot always rely on the claims the company makes in the annual report. This is because it may not be audited. Auditing information in the annual report is not a statutory requirement in Singapore, but there are audit procedures to do so if the company wishes. We need to take a look at what the company discloses and make a judgment for ourselves.

Let’s take a look at what Singtel disclosed.

Are there proofs that backed this claim? We can see that Singtel discloses the information of what is required of SGX Listing Rule 710. Singtel also disclosure information on what is recommended in the Code of Corporate Governance. On top of that, Singtel received numerous awards for their corporate governance practice.

We would not go into details of what information is required to disclose.

We can conclude that Singtel approach is the enlightened shareholder approach. This is the optimal approach to maximize society’s value instead of maximizing any dominant shareholder or group of shareholders.

Conclusion

While we know that investing in Singtel is a good decision from a corporate governance standpoint, the price of Singtel’s shares is also a factor if it is currently overpriced of under-priced. To proceed to invest in Singtel’s shares please first do up a valuation on the share price. This article is only to educate readers like you to apply corporate governance in picking stocks.