Introduction

Before a bookkeeper can engage in accounting activities, it is first necessary to understand the basic underpinnings of accounting, as well as the general flow of accounting transactions. In this article, we describe the concept of an accounting framework and accounting principles, on which all accounting activities are based. We then give an overview of how accounting transactions are recorded and aggregated into financial statements, which involves the use of double-entry accounting and journal entries. We conclude with a discussion of the accrual and cash bases of accounting.

Financial Accounting Basics

This introductory section is intended to give an overview of financial accounting basics. Its orientation is toward recording financial information about a business. First, what do we mean by “financial” accounting? This refers to the recordation of information about money. Thus, we will talk about issuing an invoice to someone, as well as their payment of that invoice, but we will not address any change in the value of a company’s overall business since the latter situation does not involve a specific transaction involving money.

A transaction is a business event that has a monetary impact, such as selling goods to a customer or buying supplies from a vendor. In financial accounting, a transaction triggers the recording of information about the money involved in the event.

For example, we would record in the accounting records such events (transactions) as:

- Incurring debt from a lender

- The receipt of an expense report from an employee

- Selling goods to a customer

- Paying sales taxes to the government

- Paying wages to employees

We record this information in accounts. An account is a separate, detailed record about a specific item, such as expenditures for office supplies, or accounts receivable, or accounts payable.

There can be many accounts, of which the most common are:

- Cash. This is the current balance of cash held by a business, usually in checking or savings accounts.

- Accounts receivable. These are sales on credit, which customers must pay for at a later date.

- Inventory. This is items held in stock, for eventual sale to customers.

- Fixed assets. These are more expensive assets that the business plans to use for multiple years.

- Accounts payable. These are liabilities payable to suppliers that have not yet been paid.

- Accrued expenses. These are liabilities for which the business has not yet been billed, but for which it will eventually have to pay.

- Debt. This is cash loaned to the business by another party.

- Equity. This is the ownership interest in the business, which is the founding capital and any subsequent profits that have been retained in the business.

- Revenue. This is sales made to customers (both on credit and in cash).

- Cost of goods sold. This is the cost of goods or services sold to customers.

- Administrative expenses. These are a variety of expenses required to run a business, such as salaries, rent, utilities, and office supplies.

- Income taxes. These are the taxes paid to the government on any income earned by the business.

How do we enter information about transactions into these accounts? There are two ways to do so:

• Software module entries. If accounting software is being used to record financial accounting transactions, there will probably be on-line forms to fill out for each of the major transactions, such as creating a customer or an invoice or recording a supplier invoice. Every time one of these forms is filled out, the software automatically populates the accounts for the user. At Tianlong Services, we use Xero for our clients, a cloud-based accounting software.

• Journal entries. A journal entry form can be accessed in the accounting software. Alternatively, journal entries can be created by hand; this is a more customized way to record accounting information. Xero is also able to create journal entry electronically.

The accounts are stored in the general ledger. This is the master set of all accounts, in which are stored all of the business transactions that have been entered into the accounts with journal entries or software module entries. There may be subsidiary ledgers in which are stored high-volume transactions, such as sales or purchases. Thus, the general ledger is the go-to document for all of the detailed financial accounting information about a business.

If you want to understand the detail for a particular account, such as the current amount of accounts receivable outstanding, access the general ledger for this information. In addition, most accounting software packages provide a number of reports that give better insights into the business than just reading through the accounts. In particular, there are aged accounts receivable and aged accounts payable reports that are useful for determining the current list of uncollected accounts receivable and unpaid accounts payable, respectively.

The general ledger is also the source document for the financial statements. There are several financial statements, which are:

- Balance sheet. This report lists the assets, liabilities, and equity of the business as of the report date.

- Income statement. This report lists the revenues, expenses, and profit or loss of the business for a specific period of time.

- Statement of cash flows. This report lists the cash inflows and outflows generated by the business for a specific period of time.

In summary, we have shown that financial accounting involves the recording of business transactions in accounts, which in turn are summarized in the general ledger, which in turn is used to create financial statements. We will now walk through the building blocks of an accounting system, starting with the accounting frameworks from which accounting rules are derived.

Accounting Frameworks

The accounting profession operates under a set of guidelines for how business transactions are to be recorded and reported. There is a multitude of transactions that an organization might enter into, so the corresponding guidelines are also quite large. These guidelines can be subject to interpretation, so there are standard-setting bodies that maintain and support the guidelines with official pronouncements.

Not every organization operates under the same set of guidelines. There may be different guidelines for different types of entities, and slight differences in guidelines by country. Each of these unique guidelines is referred to as an accounting framework. Once an organization adopts a certain accounting framework, it continues to record transactions and report financial results in accordance with the rules of that framework on a long-term basis.

Doing so provides the users of its financial reports with a considerable amount of reporting continuity. Also, because an accounting framework provides a consistent set of rules, anyone reading the financial statements of multiple companies that employ the same framework has a reasonable basis for comparison.

The required accounting framework in Singapore is SFRS, which is short for the Singapore Financial Reporting Standards.

The accounting information in this book is based on the SFRS

framework.

Accounting Principles

There are a number of accounting principles upon which the accounting frameworks are based. These principles have been derived from common usage, as well as from the documentary efforts of several standard-setting organizations. The principles are:

Accrual principle

The concept that accounting transactions should be recorded in the accounting periods when they actually occur, rather than in the periods when there are cash flows associated with them. This is the foundation of the accrual basis of accounting (as described in a later section). It is important for the construction of financial statements that show what actually happened in an accounting period, rather than being artificially delayed or accelerated by the associated cash flows. For example, if a company ignores the accrual principle, it records an expense only after paying for it, which might incorporate a lengthy delay caused by the payment terms for the associated supplier invoice.

Conservatism principle

The concept that expenses and liabilities should be recorded as soon as possible, but revenues and assets are recorded only when it is certain that they will occur. This introduces a conservative slant to the financial statements that may yield lower reported profits, since revenue and asset recognition may be delayed for some time. This principle tends to encourage the recordation of losses earlier, rather than later. The concept can be taken too far, where a business persistently misstates its results to be worse than is realistically the case.

Consistency principle

The concept that, once a business adopts an accounting principle or method, the company should continue to use it until a demonstrably better principle or method comes along. Not following the consistency principle means that a business could continually jump between different accounting treatments of its transactions that make its long-term financial results extremely difficult to discern.

Cost principle

The concept that a business should only record its assets, liabilities, and equity investments at its original purchase costs. This principle is becoming less valid, as many accounting standards are heading in the direction of adjusting to the current fair value of many items.

Economic entity principle

The concept that the transactions of a business should be kept separate from those of its owners and other businesses. This prevents the intermingling of assets and liabilities among multiple entities.

Full disclosure principle

The concept that one should include in or alongside the financial statements of business all of the information that may impact a reader’s understanding of those financial statements. The accounting standards have greatly amplified this concept in specifying an enormous number of informational disclosures.

Going concern principle

The concept that a business will remain in operation for the foreseeable future. This means that a business would be justified in deferring the recognition of some expenses, such as depreciation, until later periods. Otherwise, the company would have to recognize all expenses at once and not defer any of them.

Matching principle

The concept that, when revenue is recorded, all related expenses should be recorded at the same time. Thus, a business charges inventory to the cost of goods sold at the same time that it records revenue from the sale of those inventory items. This is a cornerstone of the accrual basis of accounting.

Materiality principle

The concept that one should record a transaction in the accounting records if not doing so might have altered the decision-making process of someone reading the company’s financial statements. This is quite a vague concept that is difficult to quantify, which has led some of the more picayune accountants to record even the smallest transactions.

Monetary unit principle

The concept that a business should only record transactions that can be stated in terms of a unit of currency. Thus, it is easy enough to record the purchase of a fixed asset, since it was bought for a specific price, whereas the value of the quality control system of a business is not recorded. This concept keeps a business from engaging in an excessive level of estimation in deriving the value of its assets and liabilities.

Reliability principle

The concept that only those transactions that can be proven should be recorded. For example, a supplier invoice is a solid evidence that an expense has been recorded. This concept is of prime interest to auditors, who are constantly in search of the evidence supporting transactions.

Revenue recognition principle

The concept that one should only recognize revenue when a business has substantially completed the earnings process.

Time period principle

The concept that a business should report the results of its operations over a standard period of time. This may qualify as the most glaringly obvious of all accounting principles but is intended to create a standard set of comparable periods, which is useful for trend analysis.

It may not initially appear that accounting principles are

of much use on a day-to-day basis. However, when there is a question about the

proper treatment of a business transaction, it is sometimes useful to resolve

the question by viewing the guidance in the relevant accounting framework in

light of these accounting principles. Doing so may indicate that one solution

more closely adheres to the general intent of the framework, and so is a better

solution.

The Accounting Cycle

The accounting cycle is a sequential set of activities used to identify and record an entity’s individual transactions. These transactions are then aggregated at the end of each reporting period into financial statements. The accounting cycle is essentially the core recordation activity that a bookkeeper engages in, and is the basis upon which the financial statements are constructed. The following discussion breaks the accounting cycle into the treatment of individual transactions and then closing the books at the end of the accounting period.

The accounting cycle for individual transactions is:

1. Identify the event causing an accounting transaction, such as buying materials, paying wages to employees, or selling goods to customers.

2. Prepare the business document associated with the accounting transaction, such as a supplier invoice, customer invoice, or cash receipt.

3. Identify which accounts are affected by the business document.

4. Record in the appropriate accounts in the accounting database the amounts noted on the business document.

The preceding accounting cycle steps were associated with individual transactions.

The following accounting cycle steps are only used at the end of the reporting period, and are associated with the aggregate amounts of the preceding transactions:

5. Prepare a preliminary trial balance, which itemizes the debit and credit totals for each account.

6. Add accrued items, record estimated reserves, and correct errors in the preliminary trial balance with adjusting entries. Examples are the recordation of an expense for supplier invoices that have not yet arrived, and accruing for unpaid wages earned.

7. Prepare an adjusted trial balance, which incorporates the preliminary trial balance and all adjusting entries. It may require several iterations before this report accurately reflects the results of operations of the business.

8. Prepare financial statements from the adjusted trial balance.

9. Close the books for the reporting period.

In the following sections, we expand upon a number of the

concepts just noted in the accounting cycle, including accounting transactions

and journal entries. Ledgers and the trial balance are described separately in

The Ledger Concept article.

Accounting Transactions

An accounting transaction is a business event having a monetary impact on the

financial statements of a business. It is recorded in the accounting records of an

organization. Examples of accounting transactions are:

- Sale in cash to a customer

- Sale on credit to a customer

- Receive cash in payment of an invoice owed by a customer

- Purchase fixed assets from a supplier

- Record the depreciation of a fixed asset over time

- Purchase consumable supplies from a supplier

- Investment in another business

- Borrow funds from a lender

- Issue a dividend to investors

- Sale of assets to a third party

Types of Transaction Cycles

A transaction cycle is an interlocking set of business transactions. Most business transactions can be aggregated into a relatively small number of transaction cycles related to the sale of goods, payments to suppliers, payments to employees, and payments to lenders.

We explore the nature of these transaction cycles in the following bullet points:

- Sales cycle. A company receives an order from a customer, examines the order for creditworthiness, ships goods or provides services to the customer, issues an invoice, and collects payment. This set of sequential, interrelated activities is known as the sales cycle, or revenue cycle.

- Purchasing cycle. A company issues a purchase order to a supplier for goods, receives the goods, records an account payable, and pays the supplier. There are several ancillary activities, such as the use of petty cash or procurement cards for smaller purchases. This set of sequential, interrelated activities is known as the purchasing cycle, or expenditure cycle.

- Payroll cycle. A company records the time of its employees, verifies hours and overtime worked, calculates gross pay, deducts CPF and other self-help group funds, and issues paychecks to employees. Other related activities include the payment of withheld income taxes to the government, as well as the issuance of annual IR8A forms to foreign employees. This cluster of activities is known as the payroll cycle.

- Financing cycle. A company borrows money from lenders, followed by a series of interest payments and repayments of the debt. Also, a company issues stock to investors, in exchange for periodic dividend payments and other payouts if the entity is dissolved. These clusters of transactions are more diverse than the preceding transaction cycles, but may involve substantially more money.

A key role of the accountant is to design an appropriate set

of procedures, forms, and integrated controls for each of these transaction

cycles, to mitigate the opportunities for fraud and ensure that transactions

are processed in as reliable and consistent a manner as possible.

Source Documents

Source documents are the physical basis upon which business transactions are recorded. They usually contain the following information:

- A description of the transaction

- The date of the transaction

- A specific amount of money

- An authorizing signature (in some cases)

Examples of source documents and their related business transactions that appear in the financial records are:

- Bank statement. This contains a number of adjustments to a company’s book balance of cash on hand that the company should reference to bring its records into alignment with those of a bank.

- Cash register record. This can be used as evidence of cash sales, which supports recording of sales. Can be printed out from a Point-of-sale (POS) machine.

- Credit card statement/petty cash voucher. This can be used as evidence for a disbursement of funds from petty cash.

- Packing slip. This describes the items shipped to a customer, and so supports the recordation of a sale transaction.

- Receipt. This document is used as evidence that goods have been purchased.

- Sales order. This document, when coupled with a bill of lading and/or packing list, can be used to invoice a customer, which in turn generates a sale transaction.

- Supplier invoice. This document supports the issuance of a cash, check, or electronic payment to a supplier. A supplier invoice also supports the recordation of an expense, inventory item, or fixed asset.

- Time card. This supports the issuance of a paycheck or electronic payment to an employee. If employee hours are being billed to customers, the time card also supports the creation of customer invoices.

Double Entry Accounting

Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts. There is no upper limit on the number of accounts used in a transaction, but the minimum is two accounts. There are two columns in each account, with debit entries on the left and credit entries on the right. In double entry accounting, the total of all debit entries must match the total of all credit entries. When this happens, a transaction is said to be in balance. If the totals do not agree, the transaction is out of balance. An out of balance transaction must be corrected before financial statements can be created.

The definitions of a debit and credit are:

- A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry.

- A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

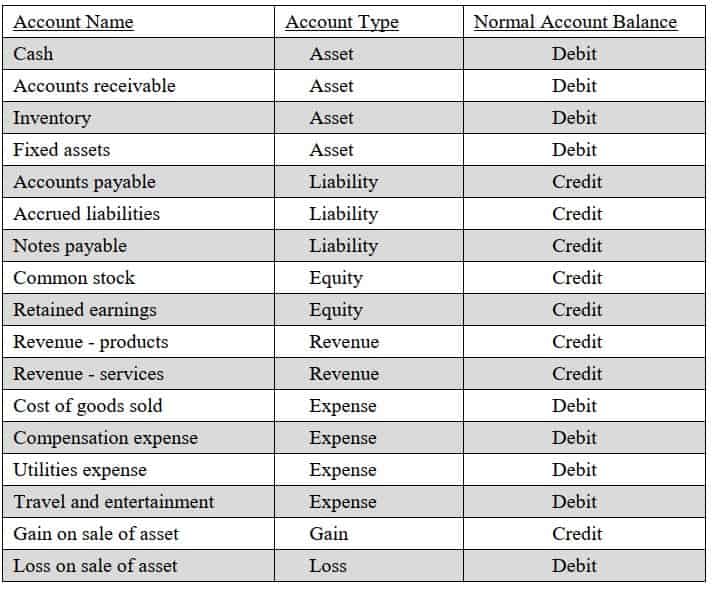

An account is a separate, detailed record associated with a specific asset, liability, equity, revenue, expense, gain, or loss. Examples of accounts are noted in the following table:

Characteristics of Sample Accounts

The key point with double-entry accounting is that a single transaction always triggers the recording in at least two accounts, as assets and liabilities gradually flow through business and are converted into revenues, expenses, gains, and losses. We expand upon this concept in the next section.

The Accounting Equation

The accounting equation is the basis upon which the double-entry accounting system is constructed. In essence, the accounting equation is:

Assets = Liabilities + Shareholders’ Equity

The assets in the accounting equation are the resources that a company has available for its use, such as cash, accounts receivable, fixed assets, and inventory. The company pays for these resources by either incurring liabilities (which is the Liabilities part of the accounting equation) or by obtaining funding from investors (which is the Shareholders’ Equity part of the equation). Thus, there are resources with offsetting claims against those resources, either from creditors or investors.

The Liabilities part of the equation is usually comprised of accounts payable that are owed to suppliers, a variety of accrued liabilities, such as sales taxes and income taxes, and debt payable to lenders.

The Shareholders’ Equity part of the equation is more complex than simply being the amount paid to the company by investors. It is actually their initial investment, plus any subsequent gains, minus any subsequent losses, minus any dividends or other withdrawals paid to the investors.

This relationship between assets, liabilities, and shareholders’ equity appears in the balance sheet, where the total of all assets always equals the sum of the liabilities and shareholders’ equity sections.

The reason why the accounting equation is so important is that it is always true – and it forms the basis for all accounting transactions. At a general level, this means that whenever there is a recordable transaction, the choices for recording it all involve keeping the accounting equation in balance.

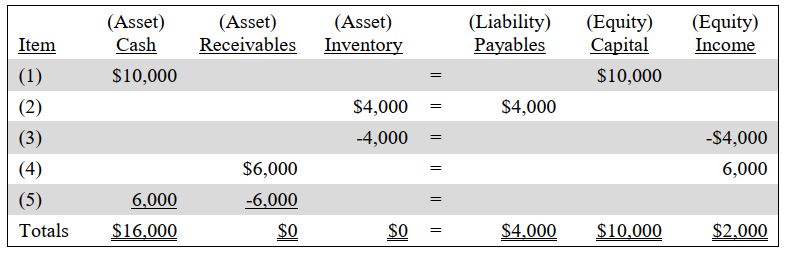

EXAMPLE

ABC Company engages in the following series of transactions:

1. ABC sells shares to an investor for $10,000. This increases the cash (asset) account as well as the capital (equity) account.

2. ABC buys $4,000 of inventory from a supplier. This increases the inventory (asset) account as well as the payables (liability) account.

3. ABC sells the inventory for $6,000. This decreases the inventory (asset) account and creates a cost of goods sold expense that appears as a decrease in the income (equity) account.

4. The sale of ABC’s inventory also creates a sale and offsetting receivable. This increases the receivables (asset) account by $6,000 and increases the income (equity) account by $6,000.

5. ABC collects cash from the customer to which it sold the inventory. This increases the cash (asset) account by $6,000 and decreases the receivables (asset) account by $6,000.

These transactions appear in the following table.

In the example, note how every transaction is balanced within the accounting equation – either because there are changes on both sides of the equation, or because a transaction cancels itself out on one side of the equation (as was the case when the receivable was converted to cash).

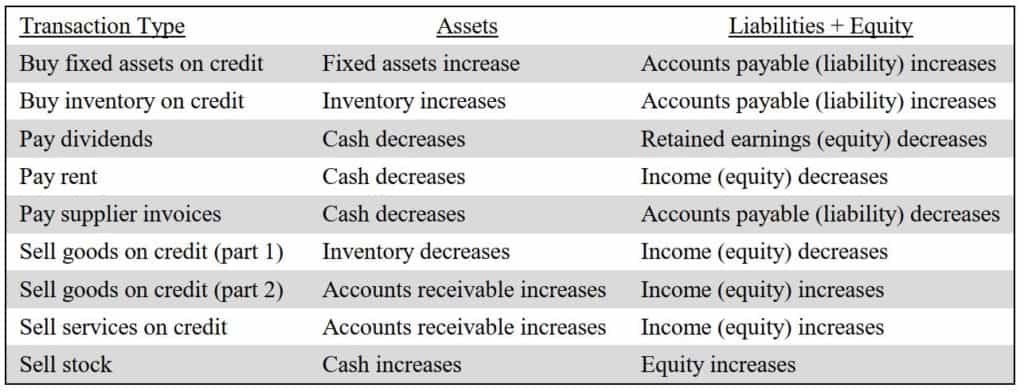

The following table shows how a number of typical accounting transactions are recorded within the framework of the accounting equation:

Here are examples of each of the preceding transactions, where we show how they comply with the accounting equation:

- Buy fixed assets on credit. ABC buys a machine on credit for $10,000. This increases the fixed assets (asset) account and increases the accounts payable (liability) account. Thus, the asset and liability sides of the transaction are equal.

- Buy inventory on credit. ABC buys raw materials on credit for $5,000. This increases the inventory (asset) account and increases the accounts payable (liability) account. Thus, the asset and liability sides of the transaction are equal.

- Pay dividends. ABC pays $25,000 in dividends. This reduces the cash (asset) account and reduces the retained earnings (equity) account. Thus, the asset and equity sides of the transaction are equal.

- Pay rent. ABC pays $4,000 in rent. This reduces the cash (asset) account and reduces the accounts payable (liabilities) account. Thus, the asset and liability sides of the transaction are equal.

- Pay supplier invoices. ABC pays $29,000 on existing supplier invoices. This reduces the cash (asset) account by $29,000 and reduces the accounts payable (liability) account. Thus, the asset and liability sides of the transaction are equal.

- Sell goods on credit. ABC sell goods for $55,000 on credit. This increases the accounts receivable (asset) account by $55,000, and increases the revenue (equity) account. Thus, the asset and equity sides of the transaction are equal.

- Sell stock. ABC sells $120,000 of its shares to investors. This increases the cash account (asset) by $120,000, and increases the capital stock (equity) account. Thus, the asset and equity sides of the transaction are equal.

Journal Entries

A journal entry is a formalized method for recording a business transaction. It is recorded in the accounting records of a business, usually in the general ledger, but sometimes in a subsidiary ledger that is then summarized and rolled forward into the general ledger (see The Ledger Concept article).

Journal entries are used in a double entry accounting system, where the intent is to record every business transaction in at least two places. For example, when a company sells goods for cash, this increases both the revenue account and the cash account. Or, if merchandise is acquired on account, this increases both the accounts payable account and the inventory account.

The structure of a journal entry is:

- A header line may include a journal entry number and entry date.

- The first column includes the account number and account name into which the entry is recorded.

- This field is indented if it is for the account being credited.

- The second column contains the debit amount to be entered.

- The third column contains the credit amount to be entered.

- A footer line may also include a brief description of the reason for the entry.

Thus, the basic journal entry format is:

Debit Account name / number $xx,xxx

Credit Account name / number $xx,xxx

The structural rules of a journal entry are that there must be a minimum of two line items in the entry and that the total amount entered in the debit column equals the total amount entered in the credit column.

A journal entry is usually printed and stored in a binder of accounting transactions, with backup materials attached that justify the entry. This information may be accessed by the company’s auditors as part of their annual audit activities.

There are several types of journal entries, including:

- Adjusting entry. An adjusting entry is used at month-end to alter the financial statements to bring them into compliance with the relevant accounting framework. For example, a company could accrue unpaid wages at month-end in order to recognize the wages expense in the current period.

- Compound entry. This is a journal entry that includes more than two lines of entries. It is frequently used to record complex transactions, or several transactions at once. For example, the journal entry to record a payroll usually contains many lines, since it involves the recordation of numerous tax liabilities and payroll deductions.

- Reversing entry. This is an adjusting entry that is reversed as of the beginning of the following period, usually because an expense was accrued in the preceding period, and is no longer needed. Thus, a wage accrual in the preceding period is reversed in the next period, to be replaced by an actual payroll expenditure.

In general, journal entries are not used to record

high-volume transactions, such as customer billings or supplier invoices. These

transactions are handled through specialized software modules that present a

standard on-line form to be filled out. Once the form is complete, the software

automatically creates the accounting record. This is also known as computer

generated journal entry or automatic journal entry.

Major Journal Entries

The following journal entry examples are intended to provide an outline of the general structure of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries.

In each of the following journal entries, we state the topic, the relevant debit and credit, and additional comments as needed.

Revenue journal entries:

- Sales entry. Debit accounts receivable and credit sales. If a sale is for cash, the debit is to the cash account instead of the accounts receivable account.

- Allowance for doubtful accounts entry. Debit bad debt expense and credit the allowance for doubtful accounts. When actual bad debts are identified, debit the allowance account and credit the accounts receivable account, thereby clearing out the associated invoice.

Expense journal entries:

- Accounts payable entry. Debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit the cash account.

- Payroll entry. Debit the wages expense and payroll tax expense accounts, and credit the cash account. There may be additional credits to account for deductions from benefit expense accounts, if employees have permitted deductions for benefits to be taken from their pay.

- Accrued expense entry. Debit the applicable expense and credit the accrued expenses liability account. This entry is usually reversed automatically in the following period.

- Depreciation entry. Debit depreciation expense and credit accumulated depreciation. These accounts may be categorized by type of fixed asset.

Asset entries:

- Cash reconciliation entry. This entry can take many forms, but there is usually a debit to the bank fees account to recognize changes made by the bank, with a credit to the cash account. There may also be a debit to office supplies expense for any check supplies purchased and paid for through the bank account.

- Prepaid expense adjustment entry. When recognizing prepaid expenses as expenses, debit the applicable expense account and credit the prepaid expense asset account.

- Fixed asset addition entry. Debit the applicable fixed asset account and credit accounts payable.

- Fixed asset derecognition entry. Debit accumulated depreciation and credit the applicable fixed asset account. There may also be a gain or loss on the asset derecognition.

Liability entries:

See the preceding accounts payable and accrued expense entries.

Equity entries:

- Dividend declaration. Debit the retained earnings account and credit the dividends payable account. Once dividends are paid, this is a debit to the dividends payable account and a credit to the cash account.

- Share sale. Debit the cash account and credit the share capital account.

These journal entry examples are only intended to provide an

overview of the general types and formats of accounting entries. There are many

variations on the entries presented here that are used to deal with a broad

range of business transactions.

The Accruals Concept

An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed, respectively, and for which the related source documents have not yet been received or generated. Accruals are needed to ensure that all revenue and expense elements are recognized within the correct reporting period, irrespective of the timing of related cash flows. Without accruals, the amount of revenue, expense, and profit or loss in a period will not necessarily reflect the actual level of economic activity within a business. Accruals are a key part of the closing process used to create financial statements under the accrual basis of accounting; without accruals, financial statements would be considerably less accurate.

It is most efficient to initially record most accruals as reversing entries. This is a useful feature when a business is expecting to issue an invoice to a customer or receive an invoice from a supplier in the following period. For example, a bookkeeper may know that a supplier invoice for $20,000 will arrive a few days after the end of a month, but she wants to close the books as soon as possible.

Accordingly, she records a $20,000 reversing entry to recognize the expense in the current month. In the next month, the accrual reverses, creating a negative $20,000 expense that is offset by the arrival and recordation of the supplier invoice.

Examples of accruals that a business might record are:

• Expense accrual for interest. A local lender issues a loan to a business, and sends the borrower an invoice each month, detailing the amount of interest owed. The borrower can record the interest expense in advance of invoice receipt by recording accrued interest.

• Expense accrual for wages. An employer pays its employees once a month for the hours they have worked through the 26th day of the month. The employer can accrue all additional wages earned from the 27th through the last day of the month, to ensure that the full amount of the wage expense is recognized.

• Sales accrual. A services business has a number of

employees working on a major construction project, which it will bill when the

project’s milestone has been completed. In the meantime, the company can accrue

revenue for the amount of work completed to date, even though the work has not

yet been billed.

The Realization Concept

The realization principle is the concept that revenue can only be recognized once the underlying goods or services associated with the revenue have been delivered or rendered, respectively. Thus, revenue can only be recognized after it has been earned.

Under the SFRS 15, you will have to satisfy your performance obligation in order to recognize revenue.

The best way to understand the realization concept is through the following examples:

• Advance payment for goods. A customer pays $1,000 in advance for a custom-designed product. The seller does not realize the $1,000 of revenue until its work on the product is complete. Consequently, the $1,000 is initially recorded as a liability, which is then shifted to revenue only after the product has shipped.

• Advance payment for services. A customer pays $6,000 in advance for a full year of software support. The software provider does not realize the $6,000 of revenue until it has performed work on the product. This can be defined as the passage of time, so the software provider could initially record the entire $6,000 as a liability and then shift $500 of it per month to revenue.

• Delayed payments. A seller ships goods to a customer on credit, and bills the customer $2,000 for the goods. The seller has realized the entire $2,000 as soon as the shipment has been completed, since there are no additional earning activities to complete. The delayed payment is a financing issue that is unrelated to the realization of revenues.

• Multiple deliveries. A seller enters into a sale contract under which it sells an airplane to an airline, plus one year of engine maintenance and initial pilot training, for $25 million. In this case, the seller must allocate the price among the three components of the sale, and realizes revenue as each one is completed. Thus, it probably realizes all of the revenue associated with the airplane upon delivery, while realization of the training and maintenance components will be delayed until earned.

The realization concept is most often violated when a

company wants to accelerate the recognition of revenue, and so books revenues

in advance of all related earning activities being completed.

Accrual Basis of Accounting

The accrual basis of accounting is the concept of recording revenues when earned and expenses as incurred. This concept differs from the cash basis of accounting, under which revenues are recorded when cash is received, and expenses are recorded when cash is paid. For example, a company operating under the accrual basis of accounting will record a sale as soon as it issues an invoice to a customer, while a cash basis company would instead wait to be paid before it records the sale.

Similarly, an accrual basis company will record an expense as incurred, while a cash basis company would instead wait to pay its supplier before recording the expense. The accrual basis of accounting is required under the Singapore Financial Reporting Standards 1.

The accrual basis tends to provide more even recognition of revenues and expenses over time than the cash basis, and so is considered by investors to be the most valid accounting system for ascertaining the results of operations, financial position, and cash flows of a business. In particular, it supports the matching principle, under which revenues and all related expenses are to be recorded within the same reporting period; by doing so, it should be possible to see the full extent of the profits and losses associated with specific business transactions within a single reporting period.

The accrual basis requires the use of estimated reserves in

certain areas. For example, a company should recognize an expense for estimated

bad debts that have not yet been incurred. By doing so, all expenses related to

a revenue transaction are recorded at the same time as the revenue, which

results in an income statement that fully reflects the results of operations.

Similarly, the estimated amounts of product returns, sales allowances, and

obsolete inventory may be recorded in reserve accounts. These estimates may not

be entirely accurate, and so can lead to materially inaccurate financial

statements. Consequently, care must be used when estimating reserves.

Cash Basis of Accounting

The cash basis of accounting is the practice of only recording revenue when cash is received from a customer, and recording expenses only when cash has been paid out. However, the cash basis of accounting is not allowed under the Singapore Financial Reporting Standards.

This is because, the cash basis of accounting suffers from the following problems:

- Accuracy. The cash basis yields less accurate results than the accrual basis of accounting, since the timing of cash flows does not necessarily reflect the proper timing of changes in the financial condition of a business. For example, if a contract with a customer does not allow a business to issue an invoice until the end of a project, the company will be unable to report any revenue until the invoice has been issued and cash received.

- Manipulation. A business can alter its reported results by not cashing received checks or altering the payment timing for its liabilities.

- Lending. Lenders do not feel that the cash basis generates overly accurate financial statements, and so may refuse to lend money to a business reporting under the cash basis.

- Audited financial statements. Auditors will not approve financial statements that were compiled under the cash basis, so a company will need to convert to the accrual basis if it wants to have audited financial statements.

- Management reporting. Since the results of cash basis financial statements can be inaccurate, management reports should not be issued that are based upon it.

However, it is widely used by smaller businesses in other countries such as the USA.

Summary

The main focus of this chapter was to reveal how business transactions are recorded in the accounting database. The level of detail given was intended to provide the reader with a basic understanding of the process, rather than the more detailed knowledge needed to actually operate such a system.

With this knowledge in hand, the next step is to see how accounting information is transformed into financial statements, which is one of the main work products of the bookkeeper. This process requires a number of intervening articles, where we will describe the chart of accounts, ledgers, and how to close the books in future articles.

Only then can we see the final output, which is the income statement, balance sheet, and statement of cash flows.

Do stay in tune for our articles next week.