Corporate finance and budgeting

Financial Advisory

To survive and thrive in the current ever-changing, hyper-competitive global marketplace, Singapore business owner need corporate finance and budgeting managers who can help them understand the new dynamics and inter-relationship of forecasting, budgeting and business performance to determine their organization’s future success.

Irrespective of size, all businesses experience fluctuation in their finances at some point in time. Therefore, creating a budget is essential to manage your money and streamline your operations. Budgeting can help your business handle all financial burdens while waiting for your payments to arrive. However, sometimes it becomes an uphill task to come up with a balanced budget and that’s when you need an expert like Tianlong Services.

Purpose of the Financial Budget for Your Business

The financial budget helps your business to plan and control cash flow. The financial budget is always the last of the budgets to be prepared, before consolidating the master budget. This is because the information that is needed is presented in the operating, production, supply, and sales budgets.

Generally, a financial balanced budget will help you to:

- Plan your expenditure.

- Forecast your expected earnings.

- Evaluate differences between your financial plan and reality.

- Make confident financial decisions to achieve your objectives.

Example case

Why We Emphasize on Corporate Finance and Budgeting Services

We emphasize on Corporate Finance and Budgeting Services to show financial managers in Singapore how to develop meaningful goals, create strategic plans and set business objectives that lead to a dynamic new budgeting process that generates outstanding results.

Below are Corporate Finance and Budgeting Services that proficient business improvement experts at Tianlong Services carry out to help you create a stable budget to manage finances for your business in Singapore.

- Creating new approaches for increasing the accuracy of forecasting

- Developing financial strategies that are meaningful to your organization’s goals

- Transforming business objectives into challenging and successful financial strategies

- Using real-world forecasting examples and case studies to improve your budgeting.

- Understanding the differences and importance of both operational and strategic objectives

- Explaining why the financial budgeting process doesn’t meet current business needs

- Streamlining new approaches to results-oriented budgeting for business success

- Making the budget process the key management tool for outstanding performance

- Determining successful business performance practices, such as earnings, cash flow etc.

- Transforming the role of the controller into a key driver in the financial planning, budgeting and performance of organizations in today’s dynamic business environment.

Creating a business budget may seem difficult, but it’s vital for every business owner in Singapore. It’s time to take the leap as it gives you the ability to make sound financial decisions to track and grow your business.

If there are still some unanswered questions standing in your way of creating a balanced business budget, our experts at Tianlong Services are always on standby to address your challenges or concerns.

How to Conduct the Budgeting Process

We recommend that you start the budgeting process from four to six months before the start of your financial year. You can also choose to set your financial budgets and variance analysis on a monthly basis.

Starting from the initial planning stage, your company should go through a series of stages to finally implement the budget. Common processes include communication within executive management, establishing objectives and targets, developing a detailed budget, compilation and revision of budget model, budget committee review, and approval.

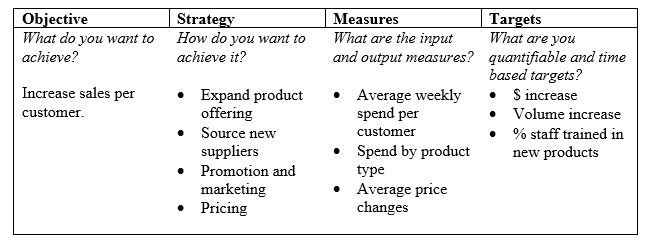

There are four dimensions to consider when translating high-level strategy, such as mission, vision, and goals, into budgets.

- Objectives are your goals.

- Strategies are actions you take to achieve your goals.

- Measures help you track and evaluate the effectiveness of the strategies.

- Targets should be quantifiable and time-based to help you focus on where you would like to reach by the end of a certain period.

No Obligation

Request a free trial

You will get a month’s worth of bookkeeping. Whether or not you continue with us, your reports for the month are yours to keep.